In the complex world of payroll and employment regulations, providing accurate and detailed pay stubs is a critical responsibility for every employer. This is especially true in states like New york, where labor laws are comprehensive and employee protections are robust. Whether your workforce includes hourly wage earners, salaried staff, or remote employees scattered across various locations, ensuring consistent and compliant pay stub issuance can be a challenging task.

In the complex world of payroll and employment regulations, providing accurate and detailed pay stubs is a critical responsibility for every employer. This is especially true in states like New york, where labor laws are comprehensive and employee protections are robust. Whether your workforce includes hourly wage earners, salaried staff, or remote employees scattered across various locations, ensuring consistent and compliant pay stub issuance can be a challenging task.

That’s where a New york pay stub generator comes in. These digital tools are designed to simplify and streamline the creation of pay stubs that meet state-specific legal requirements while New York pay stub generator accommodating the varied payroll structures of modern workplaces. In this blog, we’ll explore why using a New york pay stub generator is essential for employers managing diverse employee types, how it supports compliance, and the many benefits it brings to businesses of all sizes.

The importance of Pay Stubs in New york State

New york labor law requires employers to provide employees with detailed wage statements every pay period. These pay stubs must include specific information such as hours worked, rate of pay, gross wages, deductions, net wages, and the employer’s details. This transparency protects employees’ rights to understand how their pay is calculated and ensures employers adhere to minimum wage and overtime laws.

For hourly employees, accurate tracking and reporting of hours worked and overtime are especially crucial. For salaried workers, pay stubs verify salary amounts and any deductions applied. Remote employees, whose work locations might vary, also require clear wage statements to comply with state and local laws.

Failing to provide proper pay stubs in New york can lead to penalties, wage disputes, and damage to employer-employee trust. Hence, ensuring compliance is a top priority for all businesses operating in the state.

Challenges in Issuing Pay Stubs for a Diverse Workforce

Employers today often manage a mixed workforce that includes hourly workers paid based on actual hours worked, salaried employees on fixed wages, and remote staff who may operate under different time zones or jurisdictions. This diversity adds complexity to payroll management:

Hourly employees require detailed records of time worked, including regular and overtime hours.

Salaried employees may have deductions for benefits, taxes, or advances that must be accurately reflected.

Remote employees sometimes present complications related to tax jurisdictions and pay regulations depending on where they are physically working.

Manually creating pay stubs for such varied groups is time-consuming and increases the risk of errors or omissions, which can lead to compliance issues or employee dissatisfaction.

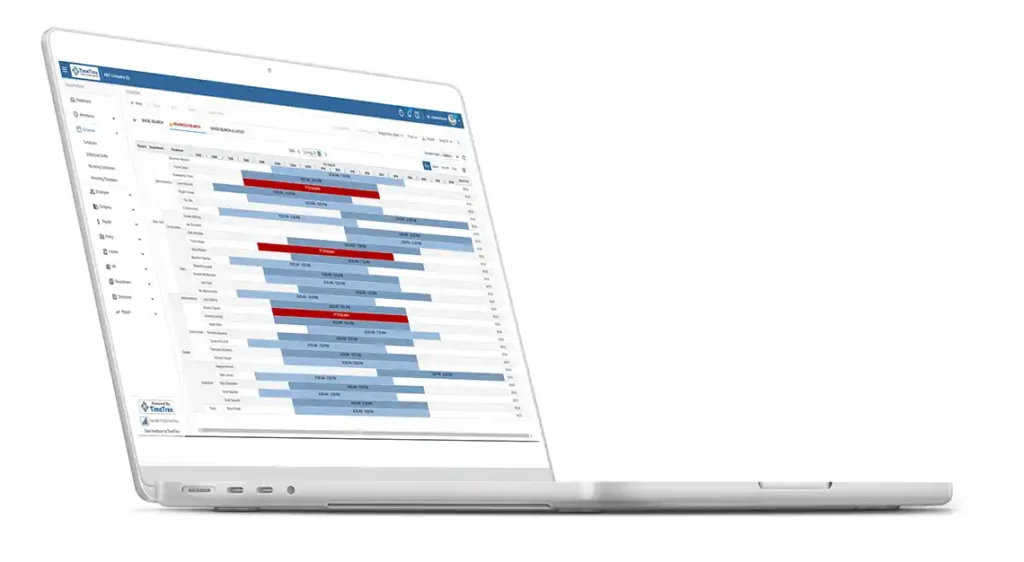

How a New york Pay Stub Generator Simplifies Payroll Documentation

A pay stub generator tailored for New york employers automates the creation of compliant, itemized pay stubs for all employee types. Here’s how it addresses the unique challenges of managing hourly, salaried, and remote workers:

Automated Calculations: It precisely calculates wages, overtime, taxes, and deductions based on hours worked or salary, reducing errors common in manual processes.

Customizable Fields: The generator includes all legally required New York-specific fields, such as employer details, pay period dates, and leave accruals, ensuring full compliance.

Multiple Pay Structures: Whether the employee is hourly, salaried, or a contractor, the system adapts to different pay models, producing accurate statements every time.

Remote Work Compatibility: For remote employees, it can incorporate multi-state tax withholdings and reflect varying labor laws, ensuring that pay stubs meet jurisdictional requirements.

This automation saves employers significant time and resources while enhancing payroll accuracy.

Benefits of Using a Pay Stub Generator for New york Employers

Ensuring Legal Compliance

New york labor laws are detailed and updated regularly. Pay stub generators often include automatic updates reflecting these changes, helping employers avoid penalties related to non-compliance. By generating pay stubs that meet all statutory requirements, businesses protect themselves from costly legal disputes and audits.

Improving Payroll Efficiency

Automating pay stub creation accelerates the payroll process. It eliminates the need for spreadsheets or manual calculations, reducing administrative burden and allowing HR teams to focus on strategic tasks rather than paperwork.

Enhancing Employee Transparency and Trust

Clear and detailed pay stubs build confidence and transparency. Employees can easily verify their hours, wages, and deductions, leading to fewer payroll-related questions or disputes. This trust fosters better employer-employee relationships and contributes to higher job satisfaction.

Supporting Remote and Hybrid Workforces

With remote work becoming a permanent part of many businesses, pay stub generators enable seamless payroll management across different locations. Electronic delivery of pay stubs ensures that remote employees receive their wage information promptly and securely, regardless of their geographic location.

Maintaining Organized Records

Pay stub generators usually store digital copies of all generated pay stubs, making it easier for employers to maintain accurate and accessible payroll records. This organization proves invaluable during audits or employee inquiries.

Scalability for Growing Businesses

Whether you’re a small startup or a large enterprise, pay stub generators scale with your business. They can handle increasing numbers of employees and more complex payroll needs without compromising accuracy or compliance.

Addressing Common Concerns and Misconceptions

Some employers worry that pay stub generators might be complicated or expensive. However, many providers offer affordable, user-friendly solutions that require no specialized accounting knowledge. Most platforms provide intuitive interfaces that guide users step-by-step through the pay stub creation process.

Additionally, the time saved and risk reduced by using a pay stub generator often outweighs any upfront costs, making it a smart investment for businesses of all sizes.

Conclusion: A vital Tool for New york Employers Managing Diverse Workforces

In today’s dynamic work environment, where hourly, salaried, and remote employees often coexist, managing payroll compliance can be complex. A new York pay stub generator offers a reliable, efficient, and legally sound way to issue accurate pay stubs that satisfy state labor requirements.